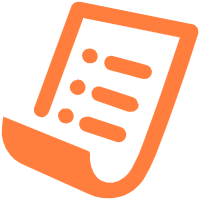

Letter of credit payment method

LC at sight is a relatively common letter of credit in the world. So how to operate LC letter of credit? You will understand after reading this article.

1. L/C is payment by letter of credit at sight.

International letters of credit are divided into remote payment letters of credit and sight payment letters of credit, and LC means sight payment letters of credit. The specific operation is that the customer makes a payment guarantee through the bank, and after receiving the documents that meet the requirements of the letter of credit, the payment is made to the customer immediately. If our foreign trade dealer delivers the goods and gets the customer's receipt, he can go directly to the corresponding bank to collect the payment. The risk of international payment through LC letter of credit is relatively low, but the cost is relatively high. In addition, when our foreign traders accept the LC payment method, they should also pay attention to check the guarantee bank qualifications of the other customer. The bank should try to choose a large and reliable bank. Otherwise, if it is a large and long-term cargo order, it is likely that due to the international economic situation, The bank failed and I couldn't get paid for the goods. In addition to sight payment methods such as LC, international letter of credit payment methods also include other long-term payment methods such as DP. But in general, whether it is a sight payment method or a forward payment method, their respective risks must be analyzed in detail. Foreign trade novices must not just look at the sight payment method and think that the sight payment method is safer and has lower risks. Small.

2. International general letters of credit except lc at sight

First of all, the types of foreign trade letters of credit can be divided according to documents, and further divided into specific responsibilities of the issuing bank, whether there are multiple banks as witnesses, payment time, whether the beneficiary of the letter of credit can transfer the letter of credit, red stripe letter of credit wait. It can also be divided according to the function of the letter of credit, and then further divided into recyclable letters of credit, folio letters of credit, back-to-back letters of credit, advance letters of credit, standby letters of credit, etc. In short, most transactions in the international foreign trade market are conducted through various letters of credit.

It should also be noted that not all letters of credit must be genuine. Some bad foreign trade people will deliberately set up some obstacles on the letter of credit, such as not opening a letter of credit in accordance with the contract. The letter of credit we get must be consistent with the letter of credit. The terms of our contracts with our customers remain exactly the same. If the letter of credit is inconsistent with the sales contract, we will not be able to get the payment for our goods from the bank. In this case, our goods have often been sent and it is difficult to recall them. However, we cannot go to the bank to collect payment with the letter of credit, which is very difficult. It is easy to cause additional losses. Therefore, our foreign traders must carefully check the terms of the letter of credit and the sales contract. In addition, special precautions must be taken to prevent some criminals from forging letters of credit, filling in relevant information by stealing blank letters of credit from banks that are about to go bankrupt, and then sending them to our foreign trade people. If our foreign trade people are not aware of it, it will eventually happen. Resulting in both front and back empty.